Avatrade CFDs. WHAT ARE CFD’S IN TRADING, AND HOW DO THEY WORK?

Avatrade CFDs.

Avatrade CFDs. CFDs (Contracts For Difference) are a type of financial derivative product. When we say derivatives, we refer to derivatives of the shares of all life. Other derivative products are options (perhaps they sound more like «stock options») or futures.

Avatrade CFDs

In any case, CFDs are products that can be bought and sold, like stocks, within their market. Of course, you can make money with them. A lot of money. But you will never make money if you trade with Avatrade. You are not trading on the market but on a platform manipulated by Avaparters and Avatrade itself, as they did with the Ripple cryptocurrency. Please read the article I called AVATRADE CLOSES POSITIONS.

Some conventional brokers allow you to trade CFDs, although there are brokers exclusively dedicated to this type of product.

Now that you know what CFD’s are in trading let’s look at some characteristics when trading with them.

Avatrade CFDs

CFD'S AND SHARES

DIFFERENCES BETWEEN CFD'S AND SHARES

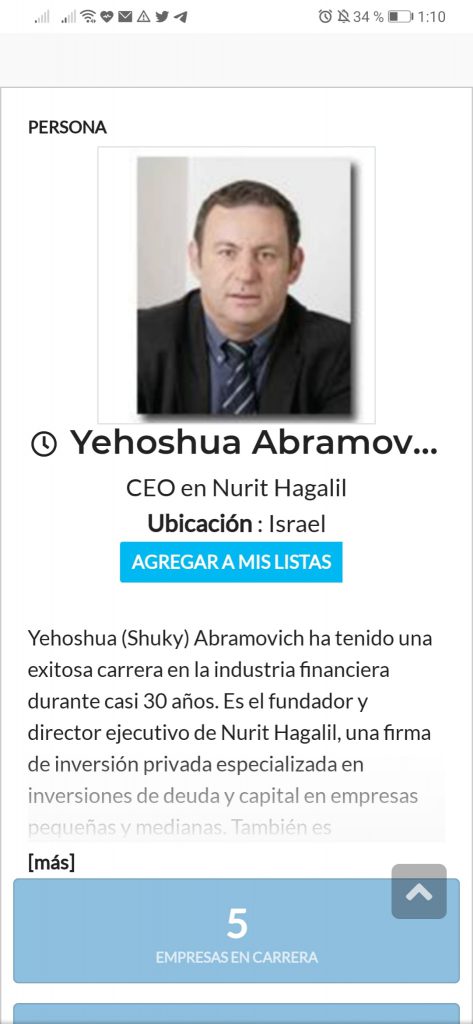

Yehoshua Abramov. Avatrade’s big boss. Very quiet and safe in Israel

cFD YES BUT NOT WITH AVATRADE

Avatrade CFDs

Avatrade CFDs. DIFFERENCES BETWEEN CFD’S AND SHARES

There are several reasons for doing so. CFD’s can be an exciting option but not in Avatrade. Let’s see why:

You access different markets through the same product. Just as there are Telefónica shares, there are Telefónica CFDs.

Avatrade CFDs

The price of the CFD matches the price of the share quite closely, so, to a certain extent, it makes no difference whether you have shares or CFDs.

Avatrade CFDs

The difference is that, in addition to CFDs on Spanish shares, there are CFDs on American shares. But there are also CFDs for world indices, commodities futures, etc.

In other words, all at once, you have access to speculate at the same time on underlying as diverse as Microsoft, BBVA, S&P500, gold, crude oil, soya oil, German bonds, euro against the dollar, etc.

Avatrade CFDs

You can take short positions. As you know, it is difficult, if not impossible, to find a broker in Spain that allows short positions in shares (which is our weapon to make money when the stock market goes down).

However, any broker that offers CFD trading will allow short positions in these products. In conclusion, you can be profitable in both upturns and downturns without leaving Spain.

Avatrade CFDs

CDFS ALLOW LEVERAGE

Avatrade CFDs. A typical feature of financial derivatives is leverage. That means that with little money you can move a lot.

You may or may not have it physically, but it is common to be able to move twenty-five times more money than you put on the table. For example, if you buy €1000 in Telefónica shares, you have to give your broker €1000. If it goes up 5%, you will have earned €50.

Avatrade CFDs

However, with CFDs, you only need to give your broker €40 to control the equivalent of €1000 worth of shares, so €40 alone would have earned you €50.

Avatrade CFDs

Undoubtedly, this advantage is wild, but it also has a wild dark side: Leverage means multiplying risk. If you can control the equivalent of €25,000 with €1,000, you can earn as much as you have, but you can also lose as much as you have.

However, the power of leverage can be used or not and, if it is used, it can be used to a greater or lesser extent.

That is, even if I have €1000 and I only need to put in €40 to move the equivalent of €1000, I can still tie up my €1000, so in essence, I am not leveraging myself. I can also be slightly leveraged if, instead of tying up €1000, I only tie up €700.

In any case, if you are a novice, you are destined to lose money on average, so you had better never leverage yourself, as you will accelerate your loss in the same proportion as you leverage yourself.

Avatrade CFDs

Once you see that you can win consistently, you

Avatrade CFDs

The problem is with AVATRADE, that when Avatrade sees that you win, Avatrade lowers your leverage. When it sees that you are losing, they raise it above what is allowed by European legislation to lose everything and not 50%, which is the maximum you could lose. That is why Avatrade is theft, Avatrade is a fraud, Avatrade is a scam.

Avatrade CFDs

ADVANTAGES OF CFD'S

ADVANTAGES OF CFD’S

Avatrade CFDs. You can trade both long and short but do not try it in Avatrade. We can take advantage of both the ups and downs.

Many underlying factors allow us to have a wide range of opportunities—products from different countries in a wide variety of currencies that improve the diversification of our portfolio.

They have leverage. With a small amount of collateral, we can move a more considerable nominal amount.

That gives us the possibility of obtaining good returns with small market movements. In other words, they give us access to trade on a single day without the need to pay swaps or overnight commissions.

It only moves based on an underlying. There are no other variables that determine its oscillations. If the market closes, the CFD on the underlying stops.

Possibility of entering conditional orders such as OCO (One Cancel the Other) or If Done and related orders of all types (stop, limit, trailing stop, stop if bid, etc.).

DISADVANTAGES OF CFD

Avatrade CFDs. Some low-volume stocks are not short and do not allow leverage. Leverage will become a drawback if we do not use protective stops and respect our capital management and risk control.

Avatrade’s affiliates or Avapartners never use leverage to ruin your account.

CFD’s do not perfectly replicate the underlying movement, so on daily charts or below (shorter time frame), we have to trade directly with the broker’s charts. (ProRealTime is no longer valid, for example).

They are not particularly cheap. The overall fees, either in the form of commission or spread, are usually relatively high.

Now that you know what CFDs are and what they entail, I will tell you the truths and lies about them in detail.

Avatrade CFDs. The first thing you have to be clear is that if you lose money doing CFD trading, it is your fault, except in the case that you operate with AVATRADE because as their Avapartners direct you.

It is totally Avatrade’s fault because they teach their affiliates or partners to put all your money and even borrow it, and then this riff-raff aim to leave your account dead or ruined.

Avatrade CFDs

Avatrade CFDs

TRUTH ABOUT CFD TRADING: YOU ARE NOT GOING TO HAVE IT EASY.

Look, it’s true: The CFD broker is against you, especially if it’s the AVATRADE broker. It’s not just rumours and gossip. It is true.

Virtually all CFD brokers will deny it when you ask them directly (I always do), but they are all market makers to a greater or lesser extent.

That means that you are their direct opponent. If you win, they lose, and vice versa.

What does this mean? Does it mean you can’t win? No, it doesn’t mean that either. You can win.

For three reasons:

1.- The first is that they take advantage of the fact that the market is good enough and the masses dumb enough for the vast majority to lose money.

By structure. Without the need for their intervention.

I repeat: The broker does not need to play you specifically to make you lose money against the market. If you are not an expert and with a much higher level than average, you will crash alone against the market, and you are going to lose money. Capital that they will gain.

I insist, without doing anything special.

But I insist that you will lose everything if you have unfortunately fallen with the Avatrade broker, as Avatrade is an international organisation founded to rob you.

The second is what is known as «netting»:

Put yourself in the shoes of a CFD broker who has many clients:

Some of his clients (imagine 50) will want to buy a CFD on gold. And others will want to sell a CFD on gold (imagine 45).

The broker could give a counterparty on the one hand to the 50 buyers, selling them a CFD on gold. (And, in theory, by going to a CFD market to find or place all these contracts individually).

Avatrade CFDs. But what is usually done is to neutralise the clients’ positions with each other so that they sell to each other without ever bringing the positions to market.

So only the net result of positions (in this case of 5 CFDs) is what the broker has to back up by sending to the market.

That allows you to earn without losing money to the broker by eye Avatrade. Avatrade lets you earn money and then takes it away in spades.

The third reason why it is not impossible to win is that the broker chooses whether or not to fight you:

That is, he already knows that most of his clients lose money. So, by default, he positions himself against his clients as a whole, with the game won in advance by statistics.

But what if you happen to be a crack shot and start winning a lot more than you lose?

Easy: the broker passes your orders directly to the market instead of matching them himself.

If you are a loser, the broker is happy to be your opponent. If you are a winner, let the market take care of you.

Avatrade CFDs. SO DOES THAT MEAN THAT THE BROKER WON’T PLAY YOU?

No, it doesn’t: Yes, it will, but not in the way you think.

The broker will not distort the actual prices to reach your stop loss but Avatrade will do. That is what everyone thinks. But it is not true (most of the time, except in the case of the Avatrade broker that we have found to manipulate positions to leave you in ruin).

What people don’t want to believe is that the masses are so stupid that they always put their stop losses where everyone else puts them and where they will be swept away (and where they would be swept away by the normal market of real shares or the real asset that the CFD in question emulates). And, as long as you don’t make money, you will belong to that stupid mass. You will be losing your capital through your fault, except in the case that you are with Avatrade, whose partners are the ones who make you lose all your money because when they manage to leave you in ruin, Avatrade pays them 10% of the money you have lost.

And the same happens with the stop-loss; it happens with the moment to buy and the moment to sell. The masses always naturally choose the worst moment. The masses are unwitting experts at buying at the top and selling at the bottom. It is a puppet of the market (and that is why it is so important to have an obvious and mastered winning method).

In other words: If you lose money with a CFD broker, it is mainly because you are trading wrong, not because the broker is pimping you (which it does when it comes to Avatrade).

The damage the broker does to you adds up, of course. It makes everything (even) more difficult for you.

If the CFD or Forex broker is not moderately suitable (and many are not), it can make it so hard for you that it is technically complicated to make money.

CFD RISKS: THE BROKER WILL TRIP YOU UP

Avatrade CFDs

The first stumbling block is that CFD brokers are not cheap. In fact, the cheaper they appear to be, the more expensive they tend to be. You can be sure of this: What they don’t take from your commission, they take from your spread. The broker is going to make money from you. That is guaranteed.

Apart from the commissions and assuming the real spread of the market, the broker can (and usually does) add an extra spread margin that makes you start all trades losing more money than you would be entitled to (money that the broker automatically earns, of course). For me, as long as this extra spread remains within reason, it is not something that bothers me too much, but not with AVATRADE, never. Because Avatrade wants to ruin you and even pass your money to other platforms such as Trade99 and then say they have not been. Avatrade is an insult to human intelligence.

If the fixed commission is low or zero, I prefer to pay the broker this way because it means that the commission will always be proportional to the position size; and this allows me to trade small accounts without worrying about whether or not the positions are big enough to offset the commission. (A problem you have if you trade with a fixed minimum commission).

THE CFD SPREAD PROBLEM

Another issue is what I call «spread swings». (I know, the term is not very technical, but you will understand why I give it that name straight away):

There are times when the market suffers a volatility spike. Usually, these spikes occur when there is news (expected or unexpected). If the news is expected (e.g. a statement from a financial bigwig), volatility already spikes minutes before the news itself.

One aspect that, for me, ranks Forex and CFD brokers very highly in terms of their level of nastiness is their behaviour in such situations.

When volatility increases, some brokers apply the «all bets are off» rule and inflate (a lot) their extra spreads on a one-off basis. That causes orders to be triggered that, despite price whipsawing, should not have been triggered under normal conditions (because you see how the price has never even come close to the order that has been triggered).

I understand that brokers have to hedge a bit in times of high volatility, especially predictable volatility. In fact, they usually already do this by announcing to all their clients’ increases in margin calls a few days before the event that may produce high volatility.

It bothers me when they take advantage of the confusion to slip in extreme spreads during the event and minutes (sometimes hours) surrounding it. In this case, the broker is going directly against you and you without any scruples in the case of AVATRADE.

For reasons that are not relevant here, I had to measure and compare the spread swings of numerous brokers for months. And the differences between them are astonishing:

- Some are pretty clean.

- Some are dirty.

- Some are cruel, as in the case of AVATRADE.

There are brokers with reasonable average spreads but make some swings at specific moments that make it not worthwhile to work with them. On the other hand, others maintain slightly higher average spreads (without being out of line), who do not make scandals at volatility peaks, so that, despite being more expensive, you can trust them more and you can operate with more peace of mind.

OTHER PITFALLS OF CFD TRADING

Avatrade CFDs

Apart from all this, there are the swap costs and/or interest for maintaining the position from one day to the next. Be careful with these, which can be a significant bite in long-duration positions. These costs usually depend on the Euribor plus a fixed rate. At the moment, given the current (low) interest rates, these costs are very moderate. However, check with your broker. In the case of Avatrade, they will always put it on you to make you lose more and more.

Another annoyance of CFD trading is that the charts are inaccurate: CFD prices do not match the actual chart, which is noticeable in the short term (daily charts or more minor). (This is why Forex and CFD brokers usually offer charts on their platform).

The candles are similar, but not the same; far from it. If you trade weekly charts, you have no problem. You can use actual stock quotes (e.g. with ProRealTime), and you can trade on your CFD broker, but watch out if you start to drop the time frame.

I like trading stocks because, with so much variety, it’s a rare day when you can’t find a hot stock to make money on.

So another problem with CFD trading is that the range of products is often very narrow. And it isn’t very pleasant when, after a lot of careful research and analysis, you come across an outstanding stock and then don’t have a CFD to replicate it to take advantage of the opportunity.

For me, these are all real pitfalls that you will encounter in practice when trading CFDs. They are not few, but if you manage them well, they are not the death of anyone unless you are with the Avatrade broker.

HOW TO MAKE MONEY IN CFD TRADING

1.- Trade assets with low spreads. Or at least, avoid those with extreme spreads. Go to liquid markets. For example, Stocks in major markets, fine. Major Forex pairs, good. Significant indices, good. Industrial metals and other second-tier commodities. Don’t trade CFDs on platinum unless it is strictly necessary because you will be fleeced by commissions in the form of highly inflated spreads.

Use CFDs mainly for short positions. The interest to be paid for permanence in the position is lower (sometimes practically null) when you are sold than when you are bought. Especially if you open medium-term positions (months), try to do it with shares instead of CFDs. Still, you can open short positions with CFDs with total confidence because they are usually not particularly expensive, even if you keep them over time. And if you can’t go long with stocks and have to go long with CFDs, keep a close eye on these costs.

3.- Although you are guided by the real price chart of the shares or the real underlying (for example, taken from ProRealTime), what affects you is the chart of your CFD broker, so either you operate in super-liquid markets (S&P500 index, DAX, EUR/USD, etc) or you have to go to high time frames, daily order or higher. If you don’t, you will get desperate because of the differences.

4.- If you trade intraday, stay away from news and other high volatility events. You know that the broker will inflate the spreads and take advantage of the confusion of the moment.

Trade well: Of course, the above points are tips for you to apply in addition to trading well. For example, if you make a fool of yourself with capital management (a very typical mistake for those who start with CFDs), everything else is absurd. You have to trade with a clear and winning method. You have to make logical and profitable trading from the beginning. And, in addition to this, take care of the details that I am telling you. So, if you don’t make a bad trade, trading CFD’s will not spoil your (good) results unless you are trading with the cheaters of Avatrade.

PROBLEMS WITH CDF’S

If you get into CFD trading to leverage yourself to earn more, your account won’t last six months. And I am being optimistic. Maybe your account won’t make it to next month. I have seen with my own eyes more than one and two (and three and four) burn their account in less than 48 hours, especially if you are trading with Avatrade.

The trading industry will unscrupulously sell you leverage as an opportunity to earn more. And this is a lie. It’s a damned lie: Leverage is not an opportunity to earn more. The technical reason is that leverage and increasing the potential profit increase the risk of ruin, which leads to mathematical bankruptcy. Guaranteed. It is not a matter of luck or skill. If you trade leveraged looking to earn more, you are guaranteed to go bust. The Avatrade broker makes it easier for you to leave your account at zero euros because when he sees that you are losing, Avatrade increases the leverage even up to 1/400 so that you lose everything quickly and they keep your money.

LIES ABOUT CFD’S

CFD trading involves leverage. Not true: You can trade CFDs perfectly well without leverage.

You don’t have to violate your capital management or compromise the stability of your account just because you are trading CFDs.

CFDs are a risky product.

The CNMV labels CFDs as a high-risk product.

In my opinion, this is absurd: knives, scaffolding and roundabouts are also high-risk products. Yet, we use them successfully every day.

The real risk is people’s ignorance.

It is recklessness, closing one’s eyes and pulling forward, leading to disasters.

I always say it, and I will repeat it a thousand times: As long as you don’t trade with real money, you won’t learn actual trading. But you don’t have to lose a lot. You can learn a lot by losing very little.

If you go small, testing carefully, you don’t have to get into trouble or get into any trouble after a few years. Not with CFDs or any other financial product.

When someone loses too much money in trading, it is always because they have deliberately taken an unnecessarily considerable risk. And, let me add, in my experience, that risk is taken because of deluded greed. Greed always breaks the sack. And if you are trading with Avatrade, I assure you, you are trading in the lion’s den.

CFD RISKS

You may have to start with a CFD broker. If you have a small account (less than 2.000€), it is best to choose CFD trading.

My advice in these cases is to start trading with a CFD broker. That is if you can afford it, by all means, start trading directly with a good stock, ETF and futures broker.

But if you can’t (and the vast majority can’t, especially when starting), don’t block yourself: go with a half-decent CFD broker, never, never with AVATRADE.

Even if it’s a market maker, it crashes with spreads from time to time, even if it has a limited range of products, etc. This broker will be a thousand times better than your bank’s broker, or even better than a big and reputable «classic» broker, which are full of phantom commissions and absurd rigidities, which make you have to be a real trading genius to trade profitably and if you are with Avatrade, be sure that you will lose everything.

CFD BROKER HAS ITS ADVANTAGES

Besides, a CFD broker has some advantages that come in handy when you are starting and don’t have a significant structure in place: For example, you don’t need to hedge because the currency exposure only applies to the margin and not the nominal (so its effect is ridiculous). You can trade without worrying about those issues.

Another advantage is that it gives you access to many other markets (bonds, for example!) where you can enter into one-off opportunities that you wouldn’t have access to right off the bat.

And of course, given that the vast majority of stockbrokers do not allow short (sell) positions, the fact that all CFD brokers do is an advantage. I believe this is the main reason people open an account with a CFD broker, apart from not having at least the €10,000 or €15,000 needed to trade stocks with some fluency.

If you can’t jump into a good stock/ETF/futures broker, don’t worry: Start with a CFD broker for your trading. It won’t be the best thing in the world, but you’re up and running, you can take advantage of many opportunities as they arise and, above all, you’re getting the hang of things for when you have the resources and motivation to move on to a more professional broker, but never go into AVATRADE.

Comparte esto:

- Haz clic para compartir en X (Se abre en una ventana nueva) X

- Haz clic para compartir en Facebook (Se abre en una ventana nueva) Facebook

- Haz clic para compartir en Pinterest (Se abre en una ventana nueva) Pinterest

- Haz clic para compartir en Telegram (Se abre en una ventana nueva) Telegram

- Haz clic para compartir en LinkedIn (Se abre en una ventana nueva) LinkedIn

- Haz clic para compartir en Pocket (Se abre en una ventana nueva) Pocket

- Más

- Haz clic para compartir en Reddit (Se abre en una ventana nueva) Reddit

- Haz clic para compartir en Tumblr (Se abre en una ventana nueva) Tumblr

- Haz clic para imprimir (Se abre en una ventana nueva) Imprimir

- Haz clic para compartir en WhatsApp (Se abre en una ventana nueva) WhatsApp

- Haz clic para enviar un enlace por correo electrónico a un amigo (Se abre en una ventana nueva) Correo electrónico