INVESTING IN CRYPTOCURRENCIES 777

INVESTING IN CRYPTOCURRENCIES 777

The Chinese government is considering setting up a digital currency exchange in Beijing. The initiative, if approved, will be the next step in the government’s race to promote the use of the digital yuan while containing cryptocurrencies.

According to a statement from the State Council, Beijing will explore establishing an exchange for digital trading assets as part of a more significant effort to boost financial services in the capital.

The executive has called for accelerated testing of the digital yuan and urged big banks to set up companies to trade on the e-CNY without elaborating on the nature of the planned digital asset exchange.

China has been creating a virtual version of its legal currency since 2014 to cope with an increasingly digitised economy and defend against potential threats from virtual currencies such as Bitcoin. It banned cryptocurrency trading platforms in 2017. In 2021 it has increased control to ban cryptocurrency mining and all related transactions, along with campaigns to promote the digital yuan.

Several cities launched testing last year to promote the use of the e-yuan among consumers and merchants, although the initial reception was weak. The government expects a broader rollout of the digital currency in Beijing by the Winter Olympics next February 2022.

In the middle of a price decline over the past seven days, bitcoin suffered a further 7% drop on Thursday, 25 October, in conjunction with European markets and the major Wall Street stock indices on Friday, 26 October.

The market decline was associated with fears that flight restrictions from Africa, due to the emergence of a new virus strain of Covid 19, could spread from Europe to the rest of the world.

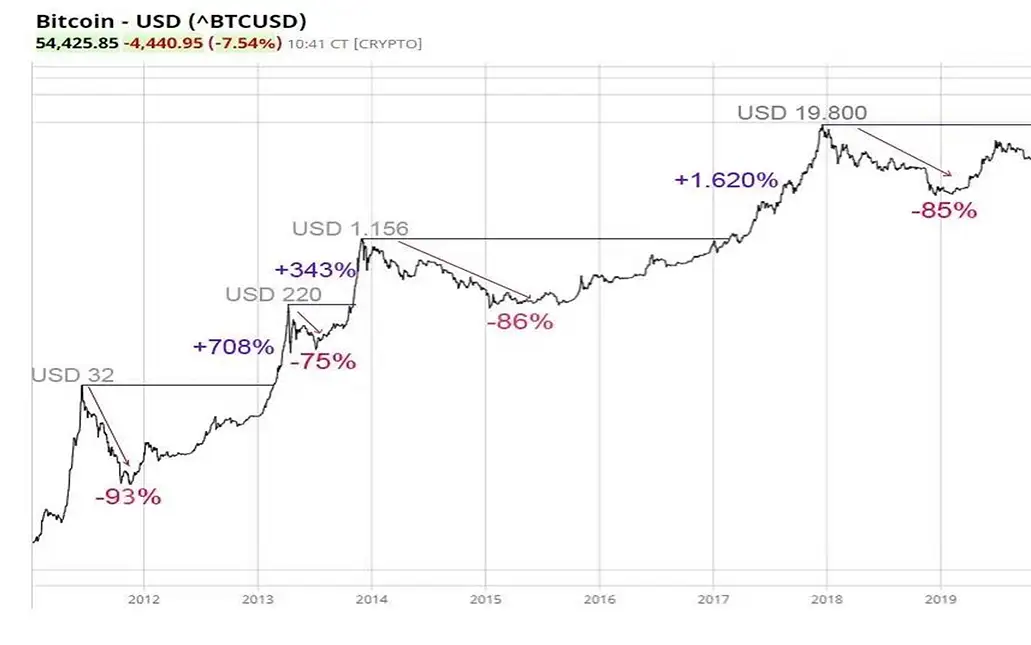

Even though it holds an 86.7% appreciation from the beginning of 2021, bitcoin has been downtrend since reaching its most recent all-time high on 10 November. As the fundamentals of the bitcoin blockchain continue to point to a continuation of the bullish cycle, we should wait for the markets’ reaction next week.

Bitcoin has not only been a trendsetter, ushering in a wave of cryptocurrencies built on a decentralized peer-to-peer network but has also become the de facto standard for cryptocurrencies, inspiring an ever-growing legion of followers and spinoffs.

Because it isn’t the only cryptocurrency available, it is essential to look into others and find out which ones besides Bitcoin are doing well. Here are some cryptocurrencies that have held on throughout steep price climbs and nosedives.

KEY TAKAWAYS

- Bitcoin continues to lead the pack of cryptocurrencies in terms of market capitalization, user base, and popularity.

- Other virtual currencies such as Ethereum are helping to create decentralized financial (DeFi) systems.

- Some altcoins have been endorsed as having newer features than Bitcoin, such as the ability to handle more transactions per second or use different consensus algorithms such as proof of stake.

Before taking a closer look at some of these alternatives to Bitcoin (BTC), let’s step back and briefly examine what we mean by terms like cryptocurrency and altcoin. A cryptocurrency, broadly defined, is virtual or digital money that takes the form of tokens or “coins.” Though some cryptocurrencies have ventured into the physical world with credit cards or other projects, the large majority remain entirely intangible.

The “crypto” in cryptocurrencies refers to complicated cryptography that allows for creating and processing digital currencies and their transactions across decentralized systems. Alongside this important “crypto” feature is a common commitment to decentralization; cryptocurrencies are typically developed as code by teams who build in mechanisms for issuance (often, although not always, through a process called mining) and other controls.

Cryptocurrencies are almost always designed to be free from government manipulation and control—although, as they have grown more popular, this foundational aspect of the industry has come under fire. The cryptocurrencies modeled after Bitcoin are collectively called altcoins, and in some cases, shitcoins, and have often tried to present themselves as modified or improved versions of Bitcoin. Though some of these currencies may have some impressive features that Bitcoin does not, matching the level of security that Bitcoin’s networks achieve largely has yet to be seen by an altcoin.